Buying overseas property means dealing in foreign currency. It can be daunting navigating currency markets, especially if it’s something you’re not used to. If your only experience of currency exchange is for your yearly holiday, you might want a better idea of how the markets work and how they’re influenced.

What influences the pound?

Exchange rates fluctuate daily, influenced like stocks, shares and government bonds, by how a country’s economy is looking. The currency markets judge that by key economic data releases such as GDP and inflation, and also political news that might affect the economy, such as elections, Budgets and conflict. The list of what can affect the currency is very long.

Bear in mind too, that it is not just the data and event itself. Currency trading is a highly sophisticated business, where traders will effectively bet on certain events happening. For example, on whether a central bank will raise interest rates next week and by how much.

If you’re looking to buy overseas, it pays off, if you pardon the pun, to use a currency specialist like Smart Currency Exchange. As well as ensuring that your property purchase or sale, or other transaction, goes smoothly, your personal trader will monitor what is happening in the near future and alert you to any factors that might influence your currency exchange. Marginal market changes may look small, but when you’re dealing with funds up to €500,000, it can make a big difference.

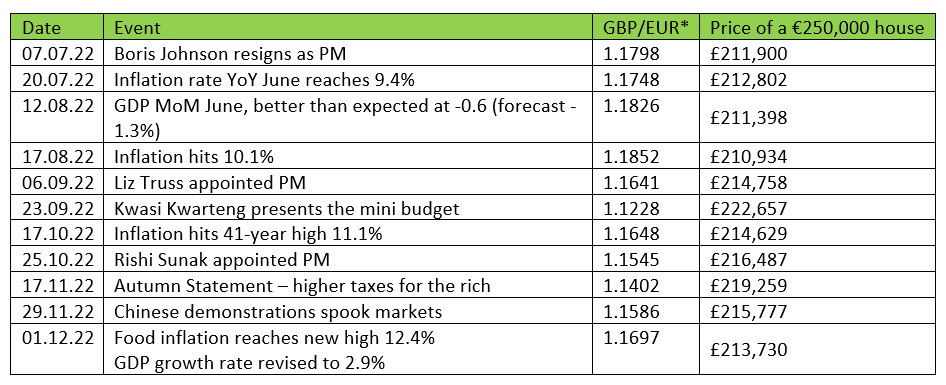

To show you just how much the pound has fluctuated in the last six months, I’ve pulled the GBP/EUR rates following key economic events from July to December.

Key events in the last 6 months that influenced the GBP/EUR rate

Please note, for illustrative purposes currency conversions are at the ‘interbank rate’, rather than the rate that an individual would achieve.

The GBP/EUR rate reached a high of 1.1852 in August and a low of 1.1228 in September following the chancellor’s mini budget. This change of less than 6 cents to the pound might not look like much, but when you apply it to a house that costs €250,000, it represents a change of £11,723 in the space of just 6 months.

GBP/EUR: the past 6 months

What can be done to avoid the risk associated with dealing in foreign currency?

If you’re worried about the risk that comes with foreign trading, speak to an independent financial advisor or a currency specialist.

At Smart Currency Exchange, we have seen every possible scenario first hand. We offer a range of bespoke services designed to help you with your exchange needs.

A forward contract, for example, allows you to lock in your exchange rate for an agreed-upon period of time. To learn more about forward contracts, click here.

A spot contract is useful for those who need to make a quick transfer, using today’s exchange rate. Click here to find out more about spot contracts.

We also offer services in:

- Payment processing

- Automatic payments

- Regular payments

- Personal service

- Risk management

If you’re buying a house overseas, why not reach out to one of our personal traders today on 020 7898 0541? They’ll help you utilise our expertise to offer bespoke services that best suit your situation.