As the UK continues its ‘roadmap to recovery’, with all COVID-19 restrictions planned to end by late June, how will the currency markets respond?

Each quarter, the major banks’ chief financial analysts predict how currencies will move over the coming months. But there is no roadmap for the pound and other currencies to follow, so even the experts cannot accurately foretell how the next quarter, or year, will play out.

Their predictions may only be educated guesswork, but they build, nonetheless, into a fascinating guide to the political, economic and, these days, health events that will influence the pound.

It’s for this reason that we strongly suggest you do not base any financial decision solely on these predictions. But do read them. The brand-new Quarterly Forecast is free to download and packed with insider tips from our own traders and analysts.

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.

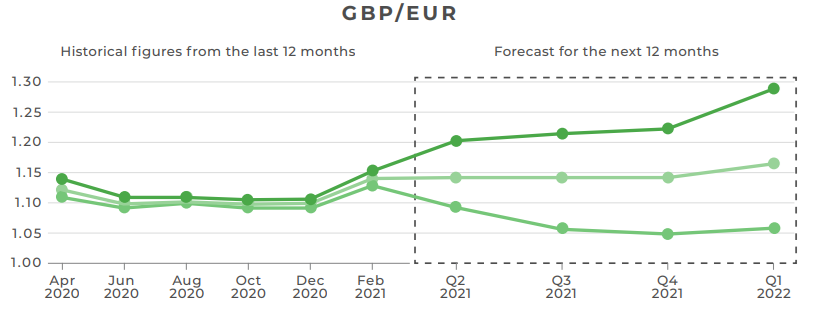

Pound verses Euro

According to some analysts, GBP/EUR could fall to around €1.06 in the next three months. Not everyone is quite so pessimistic. Predictions stretch as high as €1.21 but settle at an average of €1.14.

After the pound’s strong ascent during the first three months of this year, sterling weakened against the euro at the beginning of April. Many analysts think that the UK’s vaccine success is now ‘priced in’ to the markets and the steady progress that Europe has made since the beginning of April is helping the euro.

The progress of vaccine rollouts and the reopening of economies could continue to determine the movements of this pair. As well as this, decisions and comments from both the Bank of England and the European Central Bank could have an impact.

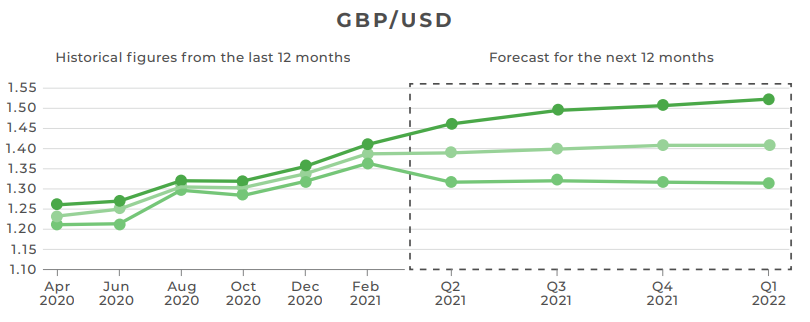

Pound verses dollar

The bank’s predictions show a huge disparity for this pairing over the next 12 months, with forecasts ranging from 1.31 to 1.51!

Treasury yields have been influencing dollar movements, causing the dollar to experience its best quarterly performance in the first three months of this year. However, their recent drop in April has since caused the dollar to weaken.

The Federal Reserve’s stance on monetary policy could also continue to impact the dollar over the next quarter. Federal Reserve Chair, Jerome Powell, has reiterated that monetary policy will not be altered until there is proof of a more ‘complete’ economic recovery in the US, despite signs of a strong recovery so far.

Further spending from the Biden administration has already had, and will continue to have, a bearing on the US’ economic recovery. It’s thought that Biden’s huge $1.9 trillion stimulus bill and $2 trillion worth of investment in infrastructure could help economic recovery on a global scale.

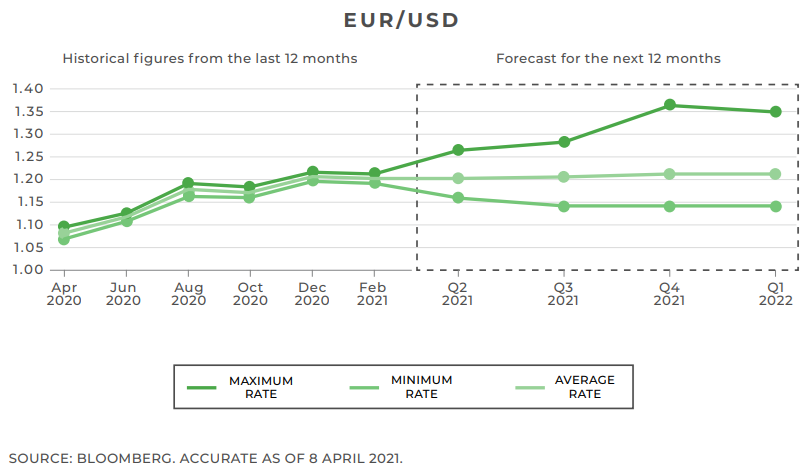

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 1.15 and 1.29 over the next three months.

After a weak start to the year, the euro has found new strength in April. Better-than-expected economic data, as well as improving vaccine rollouts and infection rates in Europe have contributed towards the euro’s strength. Vaccine programmes could continue to accelerate with the introduction of new vaccines, such as Johnson & Johnson, which was recently approved by the EU’s drug regulator.

Expectations for economic recovery and decisions from the European Central Bank could also impact the euro going forward.