With rising inflation and the actions of central banks under scrutiny, as well as the precarious nature of the pandemic, the economy, Brexit tensions and more, how will the currency markets respond?

For our readers who will be making a significant transaction overseas in the year ahead and who, therefore, could be paying thousands more or less depending on the strength of sterling, we strongly suggest you do not base any financial decision solely on the predictions from major banks.

However, whilst their predictions may only be educated guesswork, they build into a fascinating guide to the political, economic and, these days, health events that will influence the pound and other currencies.

The brand-new Quarterly Forecast is free to download and packed full of analysis and insight from our currency experts here at Smart.

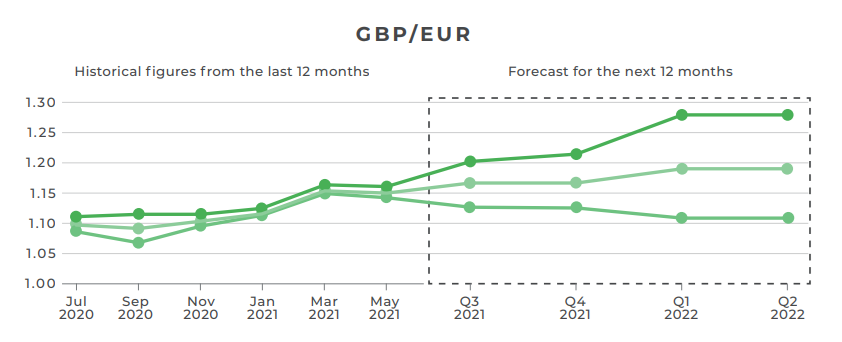

Pound versus euro

According to some analysts, GBP/EUR could fall to around €1.14 in the next three months. Not everyone is quite so pessimistic, though. Predictions stretch as high as €1.22 but settle at an average of €1.18.

Brexit tensions, the economy, COVID-19 news and decisions from central banks could have a bearing on this pair over the coming months.

Inflation is the word on everyone’s lips this quarter, with the Bank of England looking likely to tighten monetary policy ahead of the European Central Bank. Any further signs of this, such as comments from officials or data that shows UK inflation rising, could boost the pound against the euro.

Although COVID-19 has dominated the political and economic spectrum for over a year, Brexit is still a factor that could impact the currency market going forward. The UK and the EU both agree that the Northern Ireland protocol isn’t working properly, but both want to fix it in very different ways. A flare-up in tensions between the two sides over the coming months could have an impact on this currency pair.

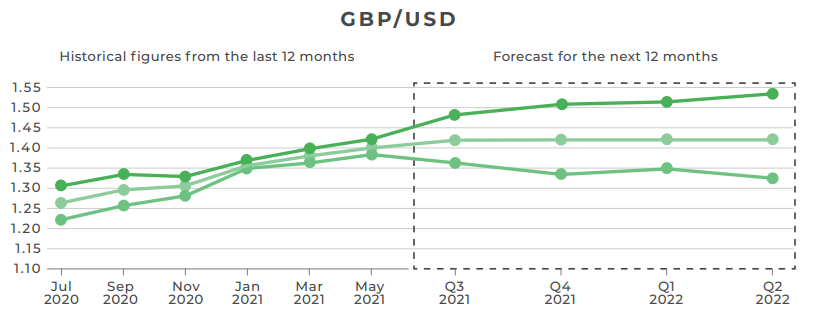

Pound versus dollar

The bank’s predictions show a huge disparity for this pairing over the next 12 months, with forecasts ranging from 1.33 to 1.54!

The dollar has recently benefitted from its status as a ‘safe-haven’ currency – a currency that investors turn to in times of uncertainty. If the Delta variant continues to gain momentum worldwide, the dollar could continue to strengthen. Alternatively, this could be outweighed by the increasing pace of vaccine rollouts in many countries.

It’s widely expected that the Federal Reserve will begin tapering post-pandemic support for the US economy more rapidly than other central banks. The Fed’s new projections also suggest that two rate hikes are expected in 2023, which is more optimistic than the original projection of 2024. If this narrative continues, the dollar could benefit.

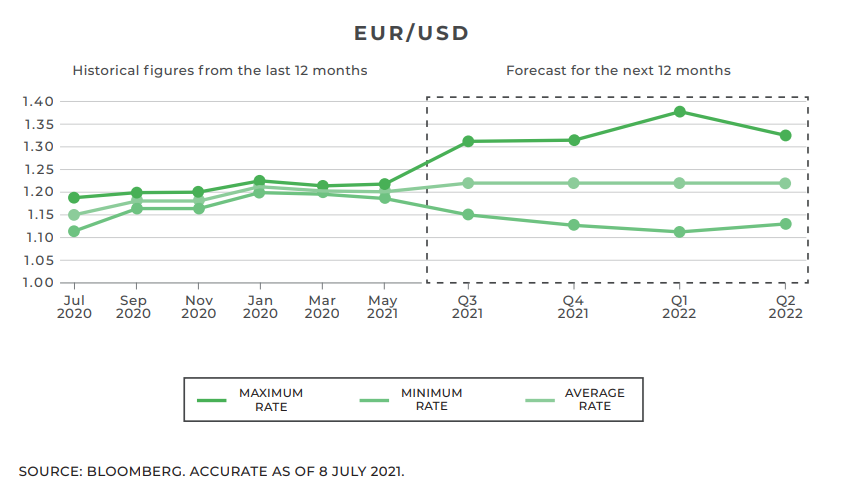

Euro versus dollar

Predictions also show a large disparity for EUR/USD, ranging between 1.14 and 1.33 over the next three months.

At its latest meeting, the European Central Bank vowed not to tighten its monetary policy until inflation reached the 2% target. The Bank has also said it will keep its bond-buying programmes until at least the end of March 2022. This reluctance to adjust interest rates could weigh on the euro as central banks race to return to a pre-pandemic ‘normal’.

ECB President, Christine Lagarde, recently said, “we agreed to maintain these measures until at least March 2022, and in any case, until we judge that the coronavirus crisis phase is over.”

Get a quote from us today by completing our simple form. We’ll take a look at your requirements and arrange to speak to you at a suitable time to offer the best possible solution for all of your upcoming currency transfers.