At the start of the year, several major banks and financial institutions predicted where the pound, euro and dollar would be by the end of Q1 of 2023 and beyond. 45 days into the year, we look at how those currency predictions have fared against reality.

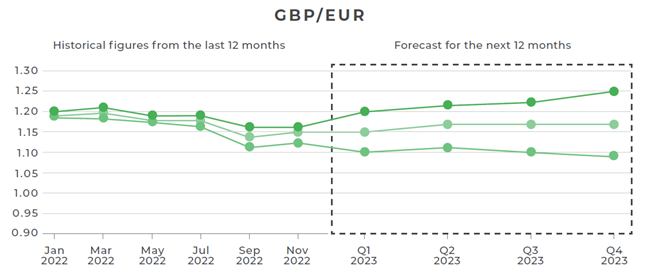

Pound versus euro

At the start of the year, some financial institutions predicted that GBP/EUR would fall to a low of €1.11 in the first quarter of 2023, while others forecast it to reach a high of €1.22.

GBP/EUR predictions as of January 6th 2023.

By 3rd February the pessimists were looking more realistic, as reports from both the IMF and Bank of England cast doubt on the UK’s speed of recovery. The interest rate decisions from the BoE, ECB and Fed brought with them a belief in the markets that interest rate rises would soon end in the UK while continuing in Europe. Sterling tumbled against the euro to €1.11 and hovered around that mark for several days before regaining its strength mid-month. Since the month’s start, the pound weakened against the euro following positive UK inflation data, which fell to 10.1%

GBP/EUR: the past year

There are still some six weeks to go until the end of Q1, so the rate could possibly fall lower or soar well above its predicted high.

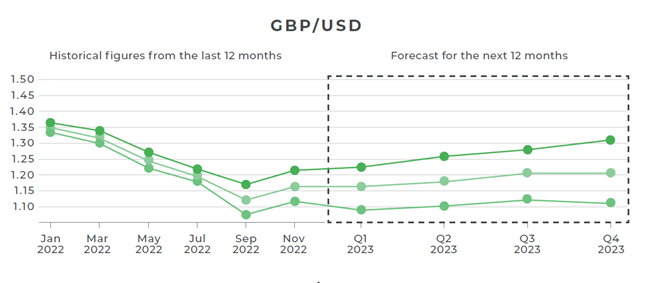

Pound versus dollar

GBP/USD predictions as of January 6th 2023.

Versus the dollar, economists’ predictions for GBP were even wider, split between the pound hitting a low of $1.10 in Q1 or reaching a peak of $1.26.

Sterling came closer to the higher prediction on 18th January and remained near a six-week high against the dollar as fears of a dovish Fed plagued markets. That lasted until early February when the interest rate decisions – allied with the booming US economy as highlighted by non-farm payrolls – saw sterling plummet and the dollar boosted against several of its competitors. Following sterling’s notable fall in early February, it has remained near the $1.20 but remains on rocky ground.

President Biden’s confident and bullish State of the Union address last night might have boosted the dollar, however comments from Federal Reserve chair Jerome Powell that ‘disinflation’ is now underway but would take a while, have weakened USD across the board.

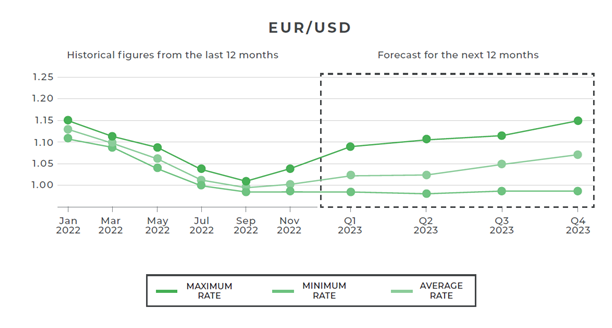

Euro versus dollar

Predictions for EUR/USD were between $0.95 and $1.11 by the end of Q1.

The euro rallied against the US dollar in the lead up to the European Central Banks’ interest rate decision on 2nd February, with investors appreciating the ECB’s more hawkish approach to interest rates – 50 basis points this month and next, compared to the Fed’s 25.

It all led to a EUR/USD peaking at close to the bank’s upper Q1 prediction on 2nd February, at $1.10, before crashing vertiginously over the following few days by over 5%.

While it is still nowhere near parity, let alone $0.95, that is still quite a drop. Moreover, while the inflation in the eurozone has slightly improved, analysts warn that expensive energy imports could still push EUR/USD back to parity in 2023.

How could this impact your exchange rates?

Currency fluctuations are inevitable in the most stable times, but the swings of early 2023 have been significant and highlight the prevalent economic uncertainty. Movements like these can seriously impact your budget’s bottom line. If you’re concerned about the risk that comes with dealing in foreign currencies, speak to your Personal Trader on 020 7898 0541 to get started.

Make sure any upcoming transactions are protected against the risks of sudden market movements. Secure a fixed exchange rate now with a forward contract; get in touch today on 020 7898 0541.